In real estate, a buyer's credit score and financial documentation are vital for mortgage approval and favorable loan terms. Responsible financial habits improve credit health, while providing lenders verifiable proof of income and stability reduces default risk. A significant down payment demonstrates commitment, influencing approval odds and interest rates, making it crucial for navigating the competitive real estate market.

In the competitive world of real estate, understanding key factors influencing mortgage approval is paramount. While credit scores play a significant role, they’re not the only determining factor. This article delves into crucial elements like documenting income and employment stability, as well as exploring the pivotal role of down payments in securing financing for your dream home. By understanding these dynamics, prospective homeowners can navigate the process more effectively.

Understanding Credit Score Impact on Mortgage Approval

In the realm of real estate, understanding your credit score is paramount when seeking mortgage approval. This numerical representation of your financial health holds significant weight in determining your eligibility for a loan and the terms offered. A higher credit score generally signifies responsible borrowing habits and increases your chances of securing favorable interest rates. Conversely, a lower score may indicate potential risks to lenders, potentially leading to less competitive terms or even denial.

When applying for a mortgage, lenders will meticulously assess your credit score as it provides a snapshot of your financial reliability. Maintaining or improving this score before applying can prove invaluable. Responsible financial behavior, such as timely bill payments and keeping credit card balances low, contributes to a robust credit profile. By understanding the impact of your credit score, prospective homebuyers can take proactive steps to increase their chances of securing the best possible mortgage terms in the competitive real estate market.

Documenting Income and Employment Stability

In the real estate world, understanding the key factors that influence mortgage approval is paramount for both lenders and borrowers. One of the most critical aspects is documenting income and employment stability. Lenders need verifiable proof of a borrower’s financial health to assess their ability to repay the loan. This typically includes tax returns, pay stubs, and employment verification forms.

By examining these documents, lenders can ensure that the borrower has a stable and consistent income stream, which significantly reduces the risk of default. Employment stability also demonstrates a borrower’s reliability and commitment, further enhancing their credibility in the eyes of the lender. This process is essential to maintaining a robust real estate market by facilitating responsible lending practices.

Down Payment: The Pivotal Factor in Real Estate Financing

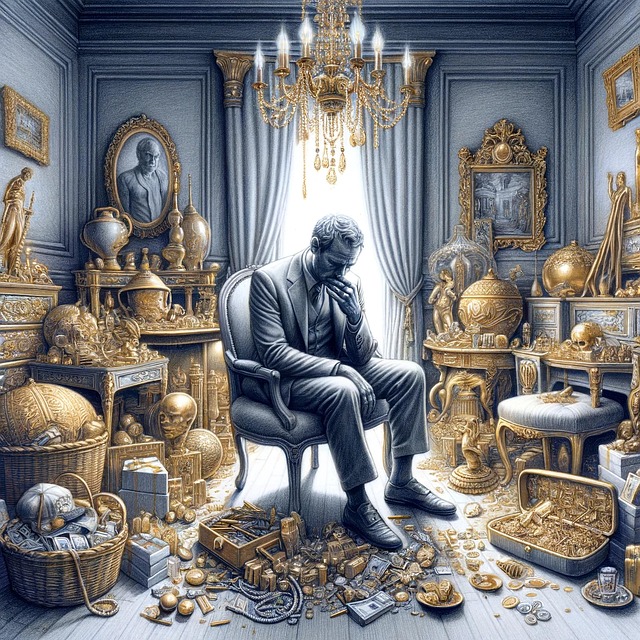

In the complex landscape of real estate financing, one factor stands as a cornerstone for mortgage approval: the down payment. This initial investment acts as a pivotal security measure for lenders, demonstrating a borrower’s commitment and financial readiness to undertake homeownership. A substantial down payment not only increases the likelihood of approval but also positively influences the terms and interest rates offered by lenders.

For borrowers, securing funds for this upfront cost can be a significant challenge, often requiring meticulous planning and savings. However, its impact on gaining access to favorable mortgage options cannot be overstated. Understanding the role of the down payment is essential in navigating the intricate process of real estate financing, ensuring individuals are well-prepared to take that crucial step towards becoming homeowners.